About Washington public power supply system bonds

The Washington Public Power Supply System (WPPSS) was formed in the 1950s to make certain that the Pacific Northwest had a constant source of electrical power. The Packwood Lake Dam was the first project undertaken by the WPPSS, and ran seven months past the expected completion date.This first.

The biggest problems were endemic cost overruns, sloppy management, and outright idiocy. An example of WPPSS's problems involved a pipe hanger, essentially a bracket.

The cost overruns reached the point where more than $24 billion would be required to complete the work, but recouping funds.

Energy Northwest (formerly Washington Public Power Supply System) is a public power joint operating agency in theUnited States, formed in 1957 bystate law to produce at-cost power for Northwest utilities.Headquartered in theat , the WPPSS became commonly (and derisively) known as "Whoops!", due to over-commitment to n.

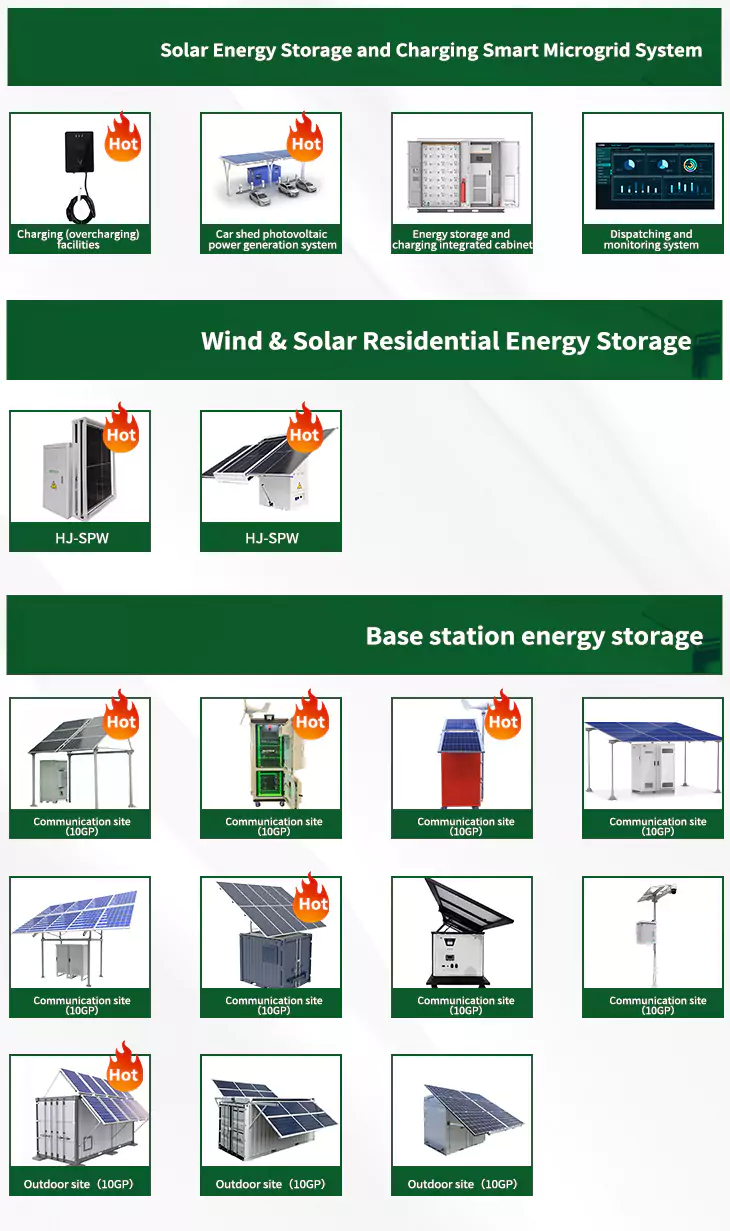

As the photovoltaic (PV) industry continues to evolve, advancements in Washington public power supply system bonds have become critical to optimizing the utilization of renewable energy sources. From innovative battery technologies to intelligent energy management systems, these solutions are transforming the way we store and distribute solar-generated electricity.

When you're looking for the latest and most efficient Washington public power supply system bonds for your PV project, our website offers a comprehensive selection of cutting-edge products designed to meet your specific requirements. Whether you're a renewable energy developer, utility company, or commercial enterprise looking to reduce your carbon footprint, we have the solutions to help you harness the full potential of solar energy.

By interacting with our online customer service, you'll gain a deep understanding of the various Washington public power supply system bonds featured in our extensive catalog, such as high-efficiency storage batteries and intelligent energy management systems, and how they work together to provide a stable and reliable power supply for your PV projects.

Related Contents

- Pacific power solar incentive program washington

- Battery power systems washington

- Battery power systems ltd washington

- Enerac power systems inc a public company

- Public power company

- Cheap backup power supply

- Backup pc power supply for computer

- Eps-01000 traction power supply system

- Power supply system unit

- Battery backup power supply sump pump

- Power supply ups

- Power supply backup battery